Bonds as a buffer - a misunderstood concept?

It’s easy to be seduced into going along with the herd when it comes to investments. When the stock market soars, we all get a little more bravado. “There’s nothing like the stock market! It’s so easy to make money! Buy! Buy! Buy!”

Similarly, when the stock market is falling, going from downturn to correction to bear, it’s just as easy to switch gears: “The market is falling and is never going to stop! Get me out! Sell! Sell! Sell!” Yes, whiplash is a thing when it comes to investing, but only if you let it be a thing.

While equities provide higher returns as compared to bonds (over time, of course), those returns generally come with more volatility. Most investors, especially older investors, wouldn’t be comfortable handling the volatility of a 100% stock portfolio. And for those who think they’ll know the precise time to buy and sell, we’ve previously covered the pitfalls in attempting to time markets.

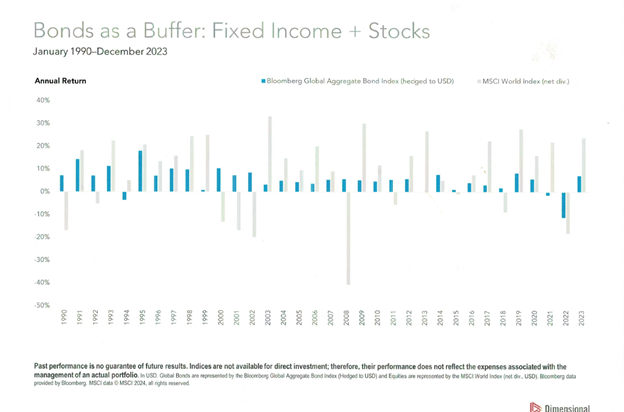

The chart below1 shows how fixed income (i.e., bonds) and stocks work together. Note how 2022 was such an outlier for bond performance, with the downturn caused by a rapid rise in interest rates. Conversely, the spectacularly bad year for equities in 2008 was well-buffered in portfolios with significant bond exposure.

Historically, bonds have played two primary roles in portfolios: hedge against severe stock market downturns and provide ongoing income. While Investments 101 teaches us that long-term investors should build diversified portfolios, there’s a big gap between building a portfolio and hanging on while the world around you is going bonkers. Admittedly, sometimes it’s hard to stay invested and do little (or nothing) while Rome seems to be burning, but that’s the beauty of owning a diverse portfolio. Diversification allows us to take a much longer perspective amid crisis after crisis.

1 “Bonds as a Buffer: Fixed Income + Stocks,” Dimensional. December 31, 2023.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by S.F. Ehrlich Associates, Inc. (“SFEA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from SFEA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SFEA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of SFEA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a SFEA client, please remember to contact SFEA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services.