Questions surrounding Social Security

Social Security is a topic we frequently discuss with clients. The two main points of discussion: (1) At what age to begin collecting Social Security benefits; and (2) The somewhat related question: Will there be any benefits left to collect?

When should I collect Social Security?

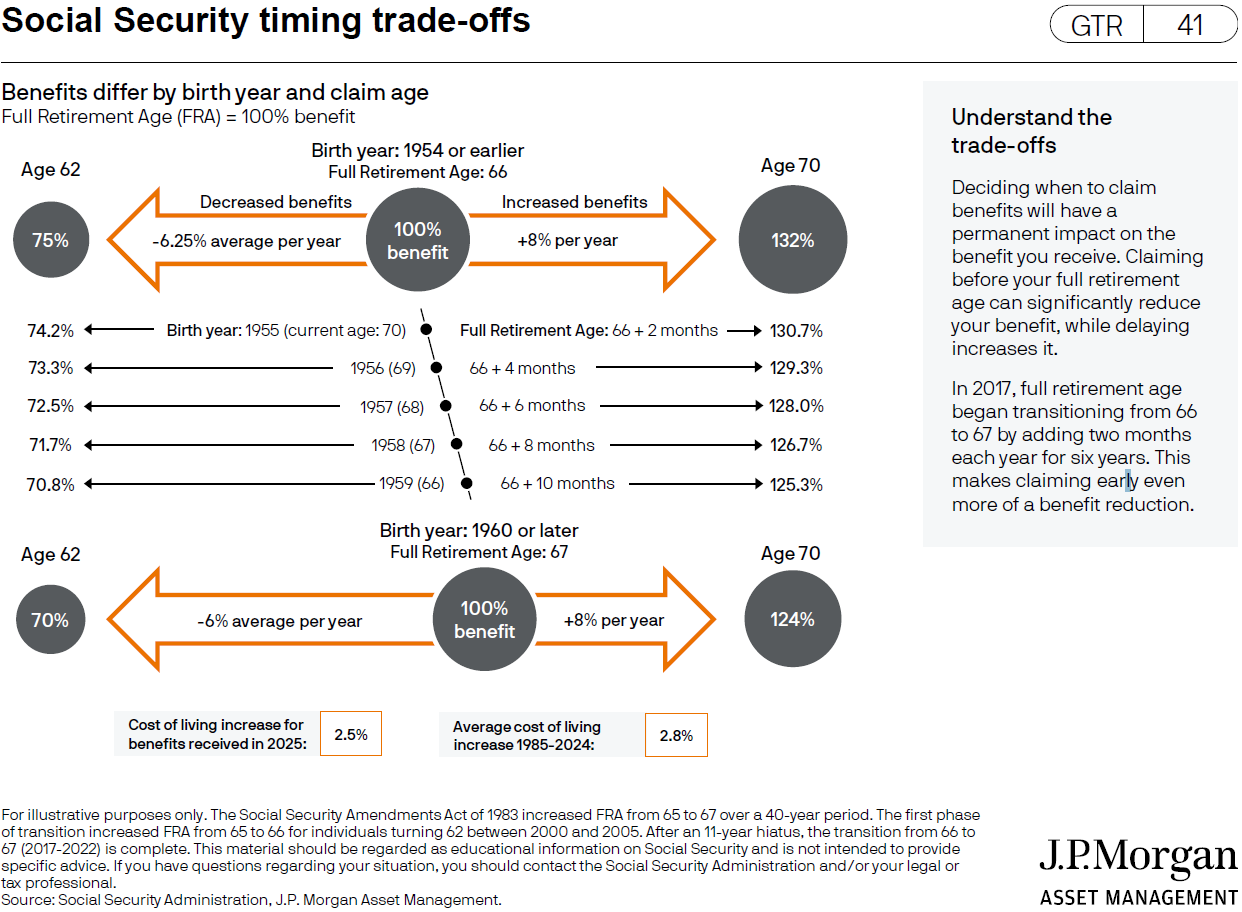

The chart below1 illustrates the variation in benefit sizes according to the year a retiree begins to claim them. Depending upon your year of birth, the difference between claiming benefits at the earliest age (62) and the maximum benefit age (70) is significant. For example, if 100% of full retirement benefits can be claimed at age 66, a retiree would collect 75% of those benefits at age 62, but 132% of the benefits at age 70. Of course, that conversation always leads to a third question: What if I don’t live to justify waiting to age 70?

What if I don’t live long enough to justify delaying collection of Social Security?

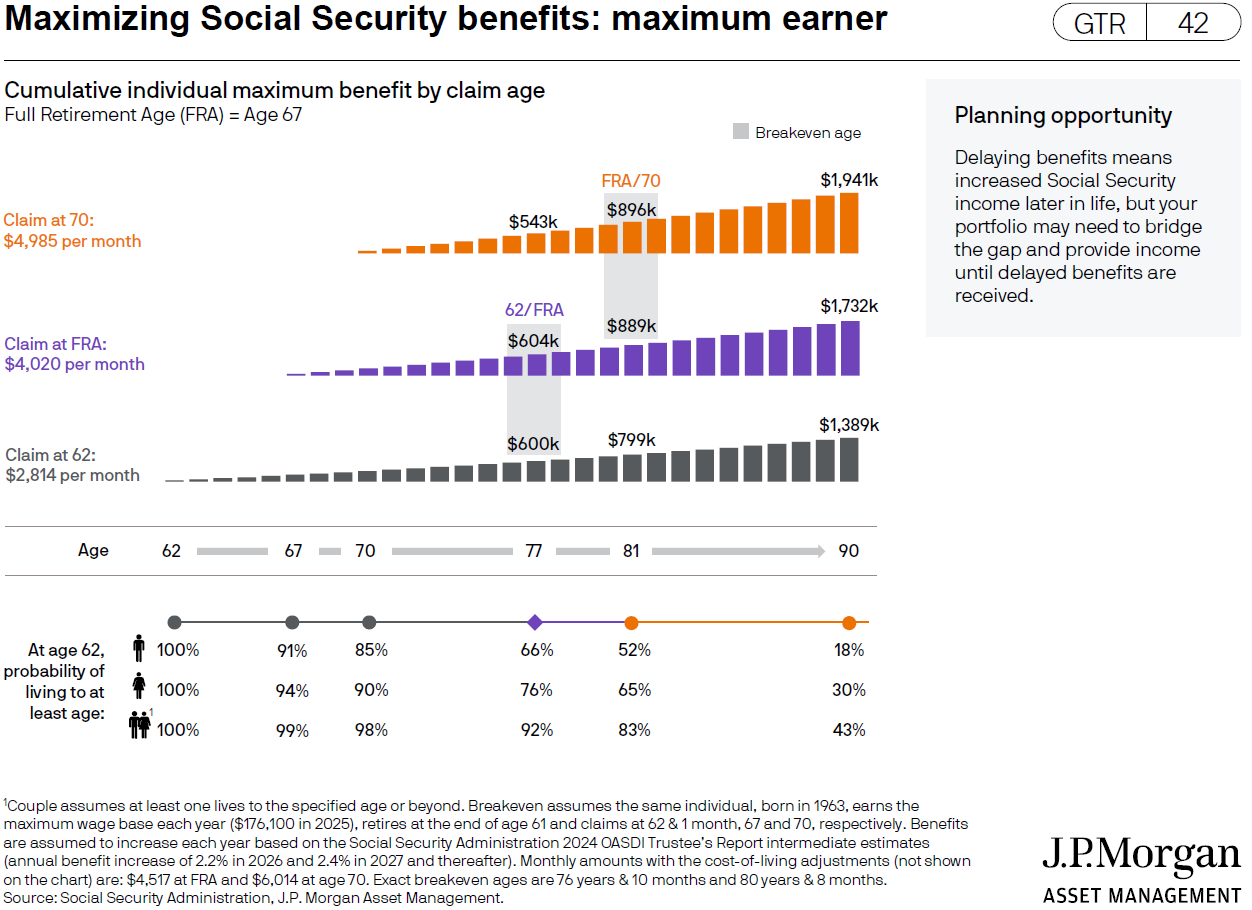

Reviewing the chart below2, assuming a full retirement age of 67, a 62-year-old would have to live to age 77 before the reduced benefits they would have collected between ages 62 and 77 exceed those had they waited until age 67 to collect benefits. He would also have to live to age 81 before exceeding the benefits he would have collected had he waited to collect until age 70.

What are the odds of living to age 77 or age 81? The probability of a 62-year-old male living to age 77 is 66%, and the probability of living to age 81 is 52%. For a 62-year-old female, the probabilities of living to ages 77 and 81 are 76% and 65%, respectively. But don’t forget one important point: if a spouse dies, the survivor receives the higher of the two benefits the couple was receiving from Social Security. Thus, deciding when to collect benefits is often not an individual decision.

Will Social Security be there when I need it?

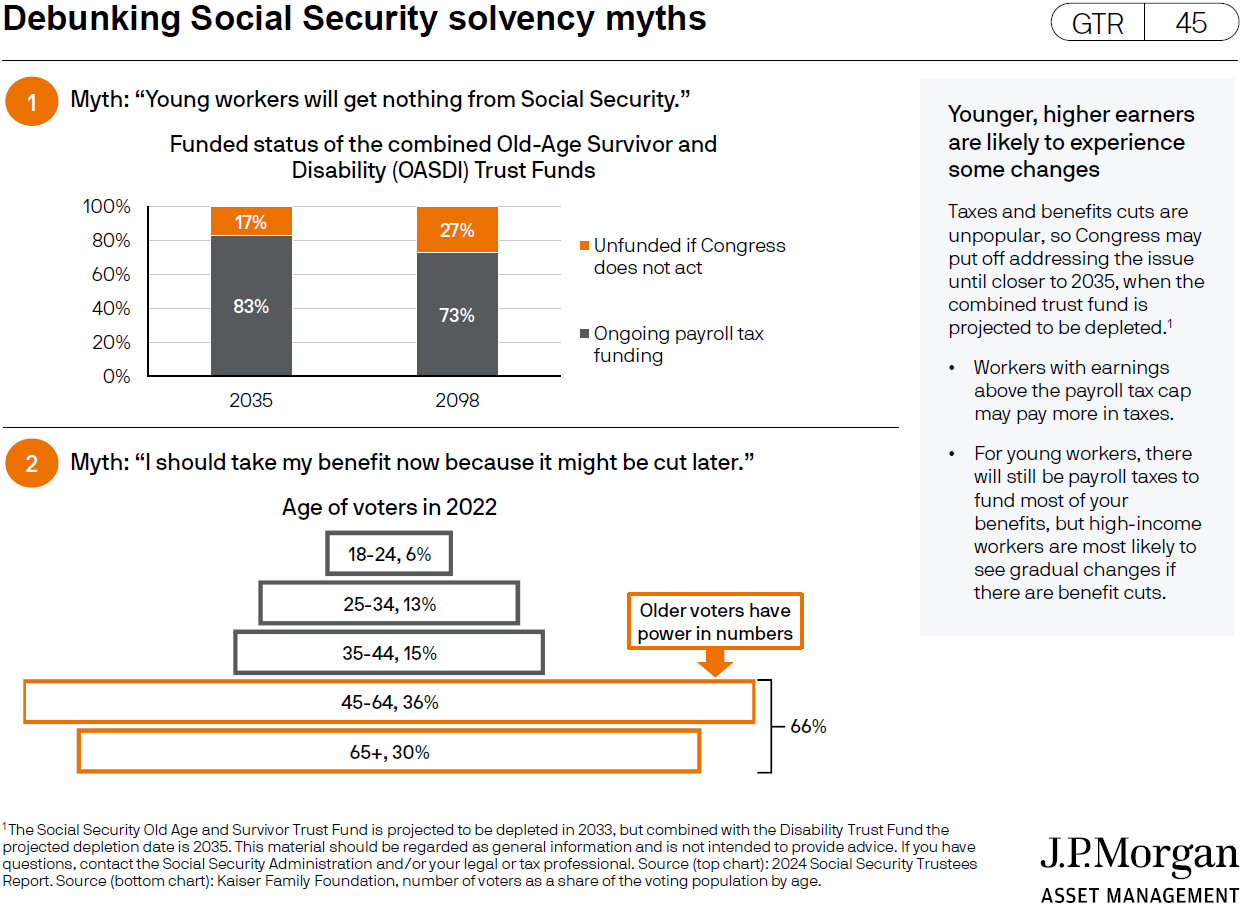

If we assume Congress doesn’t make any changes to current Social Security policy, the chart below3 shows that the Social Security Trust Fund is likely to be depleted by 2035. Even so, that means retirees in 2035 (and beyond) are still likely to receive 83% of the benefits they would have received if Social Security was 100% funded. By 2098, the shortfall is likely to be 27%.

While benefits may ultimately be reduced, the fact that workers continue to pay into the Social Security system means there will always be benefits paid to retirees. Should Congress act to fix this problem, the potential shortfall will either be reduced or eliminated.

1 “Social Security timing trade-offs,” Slide 41, Guide to Retirement, J.P. Morgan. December 31, 2024.

2 “Maximizing Social Security benefits: maximum earner,” Slide 42, Guide to Retirement, J.P. Morgan. December 31, 2024.

3 “Debunking Social Security Solvency Myths,” Slide 45, Guide to Retirement, J.P. Morgan. December 31, 2024.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by S.F. Ehrlich Associates, Inc. (“SFEA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from SFEA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SFEA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of SFEA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a SFEA client, please remember to contact SFEA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services.