Financial planning potpourri

A collection of good planning and investment points we thought worth passing along:

- Check your beneficiary forms…yet again: Many of us have old IRA or 401(k) accounts or life insurance policies that have been around for dozens of years. In almost every instance, you probably listed someone as your beneficiary. In some cases, however, that someone may no longer be an important player in your life. For some, that person may have even pre-deceased you. For others, things can be more complicated. To wit…”Jeffrey Rolison and Margaret Sjostedt dated in the 1980s. Now, almost 40 years after they broke up, she stands to inherit his $1 million retirement account. The reason she might get the money is that in 1987, Rolison listed Sjostedt on a handwritten form as the sole beneficiary of his workplace retirement account. He never changed the beneficiary designation and died in 2015.” While Rolison’s brothers are fighting his employer to have the designation voided, the funds sit in a money market account collecting interest, nine years after Rolison’s death.1

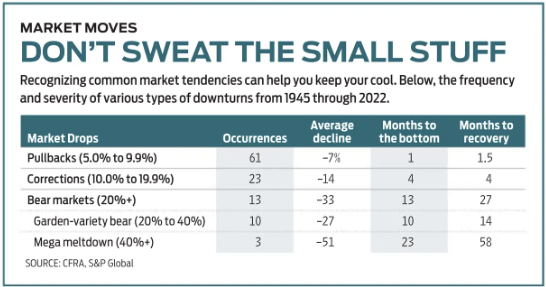

- Lean Into the Market’s Patterns2

- A few easy steps to better protect your checking and savings accounts and credit cards3:

- Make sure you have a complex and unique password to access your account online.

- Set up two-factor authentication if you haven’t already done so. An example of two-factor authentication is a unique code being texted to your phone whenever you want to log into your account. If a hacker gets hold of your password but doesn’t have your cell phone to receive the text, the hacker won’t be able to access the account.

- Set up alerts so you get immediate notification about deposits, withdrawals, and charges above a pre-determined dollar amount.

- Only log into known websites, such as those stamped on your credit card or printed on your bank statement. Googling phone numbers and websites may lead you to bad actors who can manipulate you once they have you on the line. (5) Don’t respond to emails, texts, and pop-ups, purportedly from your bank or credit card company, regardless of how urgent they appear. There’s a high probability they are attempting to hack your accounts. (See Item #4 above for your next step when you receive a random communication from your bank, credit card company, or even Schwab.)

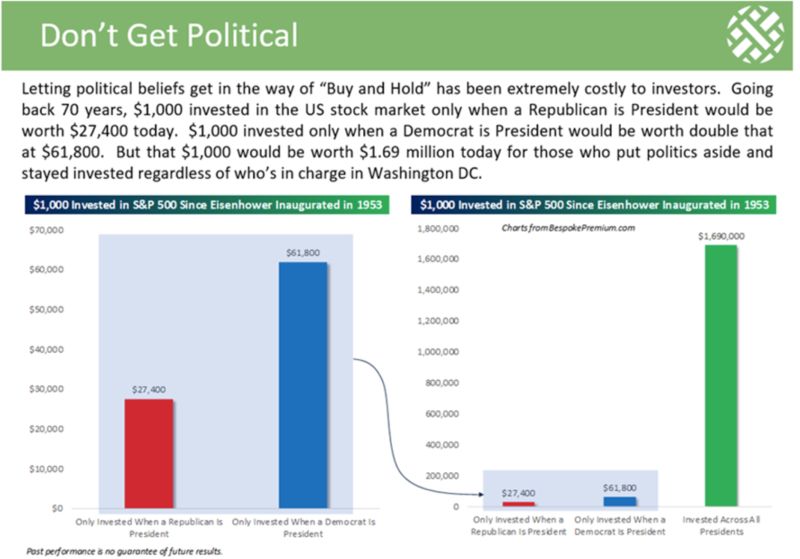

- Markets aren’t as political as you may think4

1 Ebeling, Ashlea. “His Ex Is Getting His $1 Million Retirement Account. They Broke Up in 1989.” The Wall Street Journal, 8 June 2024.

2 Decker, Michael, and Nellie S. Huang. “Lean into the Stock Market’s Patterns.” Kiplinger’s Personal Finance, 20 Aug. 2023.

3 Bennett, Karen. “Expert Advice on Protecting Your Bank Accounts from Hackers.” Bankrate, 23 Oct. 2023, www.bankrate.com/banking/protect-accounts-from-hackers/.

4 “Don’t Get Political.” Bespokepremium.com, April 30, 2024.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by S.F. Ehrlich Associates, Inc. (“SFEA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from SFEA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SFEA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of SFEA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a SFEA client, please remember to contact SFEA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services.