In Charts: Managing volatility approaching a Presidential election

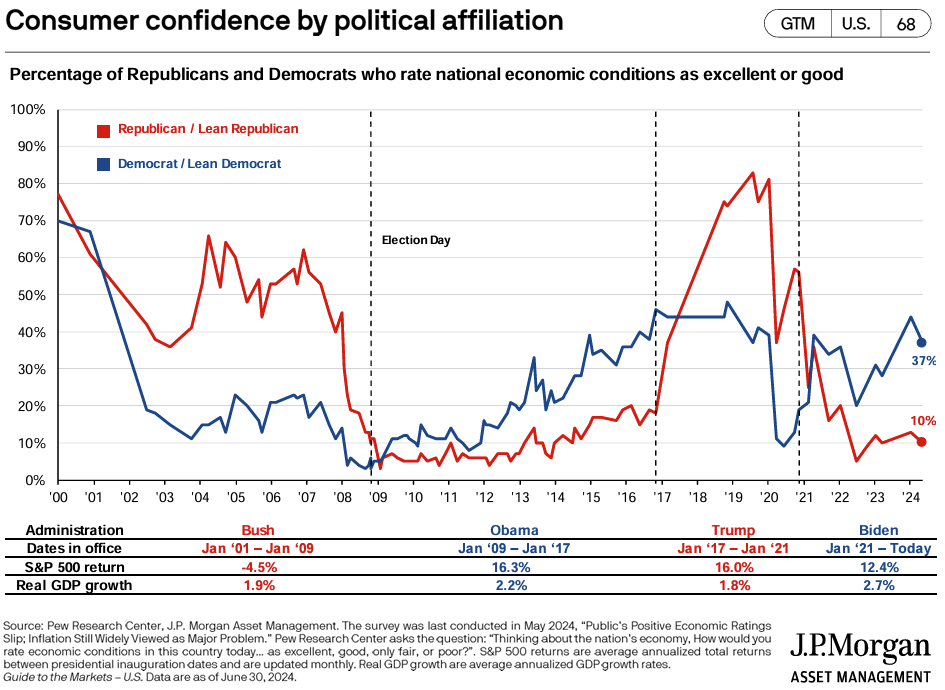

If you think you’re the only one whose mood changes if your presidential candidate wins or loses, think again1:

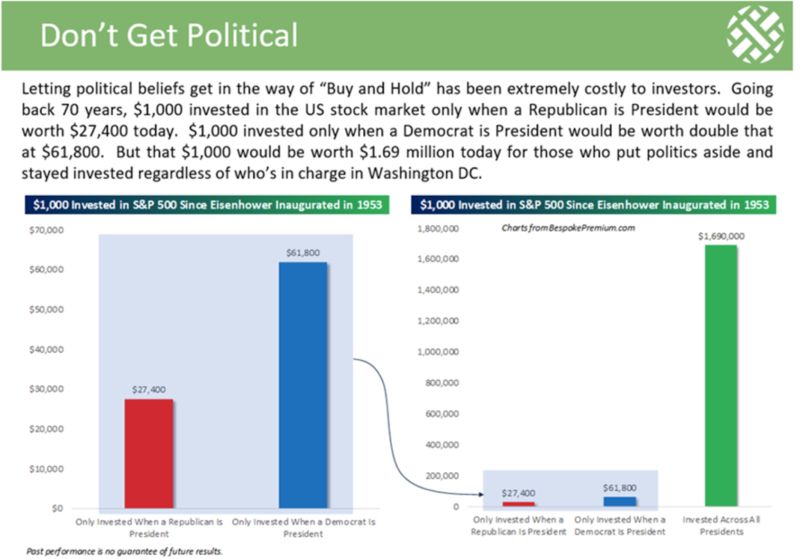

But if you’re considering changing your portfolio because you think your candidate will win (or lose), don’t forget the chart2 we included last month on market performance and the risks one takes by trying to time the market based on election results:

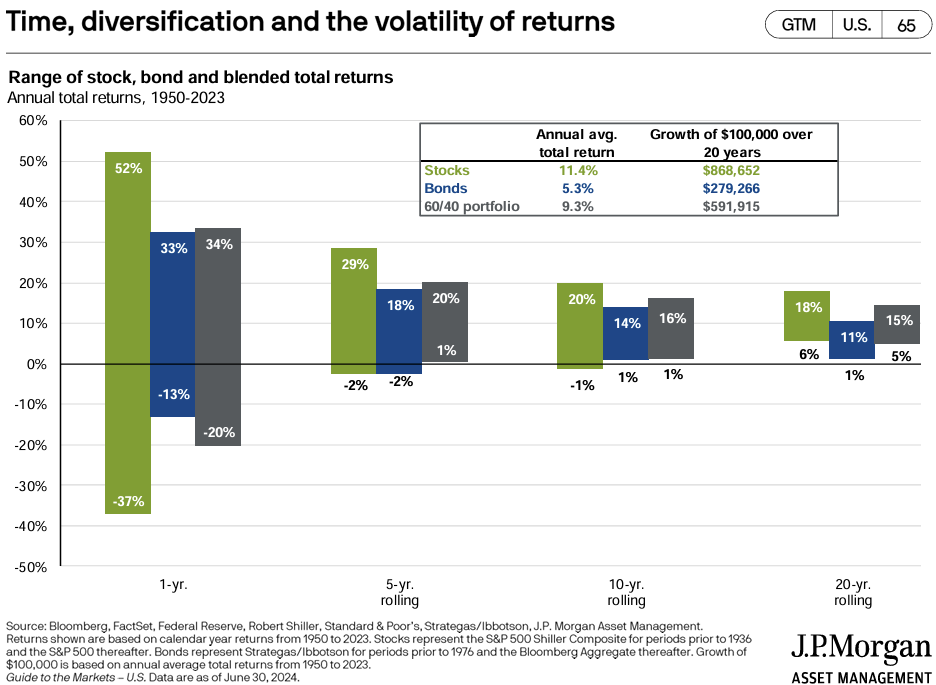

Here’s a data point3 always worth repeating: the longer the investing time frame, the less volatility RE stock market returns.

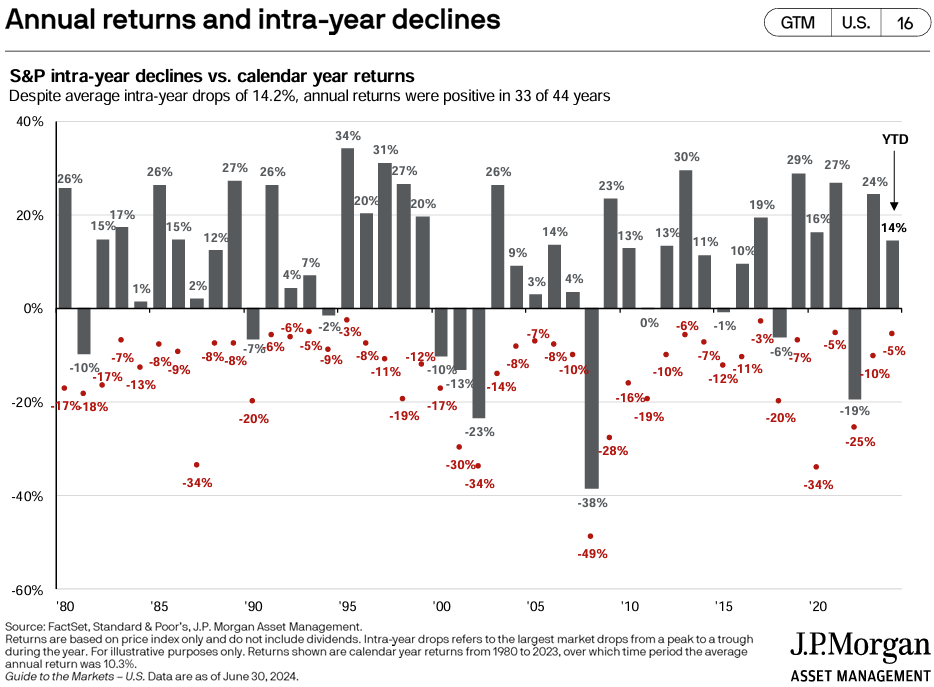

And here’s an oldie but goodie4 that reminds us not to get discouraged, even during what seems like down years. As you can see, even when markets have great years, they often have a period within that same calendar year where they were down.

1 “Consumer confidence by political affiliation,” Slide 68, Guide to the Markets, J.P. Morgan. June 30, 2024.

2 “Don’t Get Political.” Bespokepremium.com, April 30, 2024.

3 “Time, diversification and the volatility of returns,” Slide 65, Guide to the Markets, J.P. Morgan. June 30, 2024.

4 “Annual returns and intra-year declines,” Slide 16, Guide to the Markets, J.P. Morgan. June 30, 2024.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by S.F. Ehrlich Associates, Inc. (“SFEA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from SFEA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SFEA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of SFEA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a SFEA client, please remember to contact SFEA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services.