The Dangerous Myth of the "New Normal"

Frequently, when a pattern develops around an element of the stock market, investors start referring to it as a “New Normal”. The assumption, usually incorrect, is that X years of out-performance by virtually any asset class represents how things will always be in the future. Forget 100 years of market history; whatever is happening now is the New Normal.

The latest flavor of New Normal is the Magnificent Seven stocks: Nvidia, Microsoft, Apple, Amazon, Google, Meta, and Tesla. The performance of just seven companies has dominated headlines, driven U.S. stock market returns in recent months, and left investors wondering, “Should I be investing in the Magnificent Seven? Is this a New Normal?”

Writing for Morningstar1, John Rekenthaler notes that people who believe in so-called New Normals often fail over the long term, and he cautions against assuming this time will be different. One example he references is the former bond king, Bill Gross, who once managed the planet’s largest bond fund: PIMCO Total Return. (Do the words “once managed” hint at how this tale ends?)

In 2009, Gross said investors should accept they must learn to invest more conservatively and expect lower returns. (Recall the S&P 500 fell an incredible 57% just a year earlier, so many investors were prepared to believe any argument they found compelling.) Gross argued that the future for equities would bring “inexplicably low total returns.” Bill Gross’s proposed solution was, you guessed it, the PIMCO Total Return Fund.

Assets flowed into the PIMCO Total Return Fund from 2009 to 2011. Investors expected the worst because, of course, this was a New Normal.

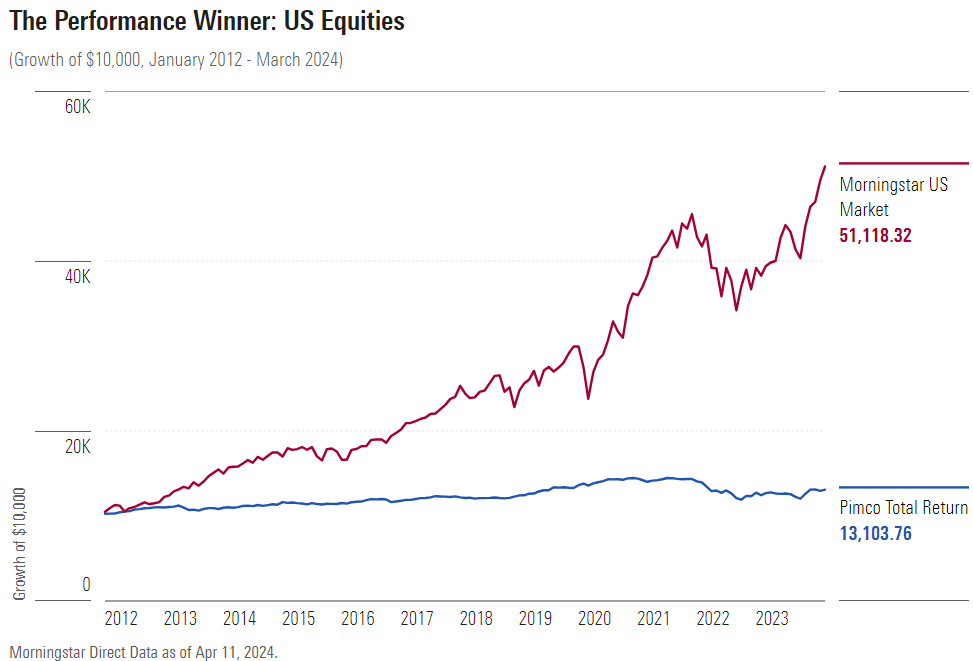

The graph below shows the returns of PIMCO Total Return vs. the Morningstar U.S. Market Index over the past 12 years. In other words, the New Normal, assuming you were a believer, resulted in significantly lower returns.

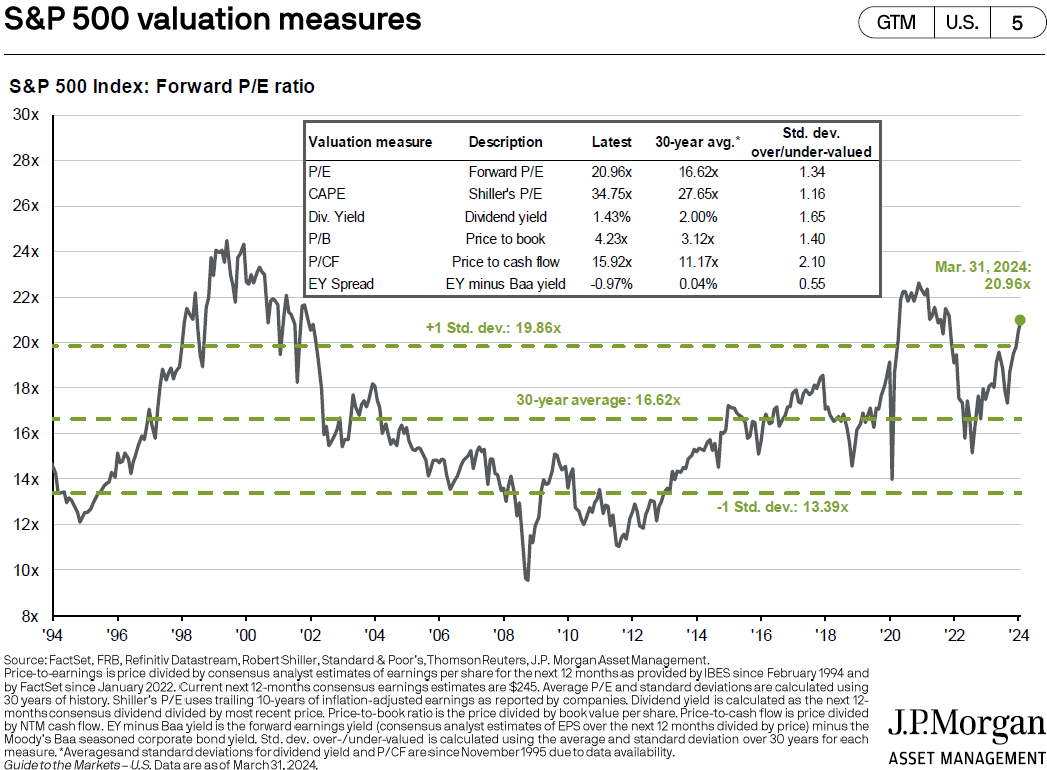

Investor psychology is an interesting phenomenon. The graph below from J.P. Morgan2 shows market peaks and valleys over the past 20 years. As markets move higher, reaching new highs in the process, there exists a fear of missing out (FOMO). That fear causes investors to often buy at the worst possible time, including some investors who vowed never to buy stocks again after absorbing losses. (In this instance, the word never is a transitory word. It’s used by certain investors until they decide it no longer applies.)

In contrast to investors who buy as markets move higher, as markets near bottoms and move lower, many so-called ‘retail’ investors sell their equity positions and head to the sidelines. Their rationale is to salvage what’s left and save what they can. Those are emotional decisions because they’re selling at the worst possible time.

Following the philosophy of periodic portfolio rebalancing, however, results in the exact opposite of the above two scenarios. The true benefit of rebalancing results from selling equities as markets move higher and reach new highs and buying when markets move toward their lows. Admittedly, disciplined rebalancing is difficult to execute because financial planners aren’t immune to emotional tilts. But the results of rebalancing portfolios, over time, are tough to dispute.

“The error Bill Gross made – as did those who followed his advice – was in discounting the power of precedent…As a result, the odds are strongly against those who alter their investment practices because they are convinced that, at long last, this time will be different.”

1 Rekenthaler, John. “The Dangerous Myth of ‘The New Normal.’” Morningstar, 11 Apr. 2024.

2 “S&P 500 Valuation Measures.” Slide 5, Guide to the Markets, J.P. Morgan. March 31, 2024.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by S.F. Ehrlich Associates, Inc. (“SFEA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from SFEA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SFEA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of SFEA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a SFEA client, please remember to contact SFEA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services.