When can I collect my Social Security retirement benefit?

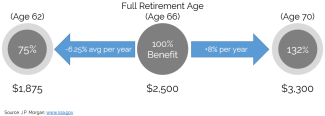

You know you're entitled to a retirement benefit from Social Security, but there seem to be a lot of rules regarding when you can actually collect it. To understand some of those rules, let’s assume we’re talking about an individual at Full Retirement Age of 66 with a Primary Insurance Amount of $2,500 per month.

Take a look at the illustration above. Every year you delay collecting benefits beyond the Full Retirement Age, the benefit increases by 8% per year. Note that this increase doesn’t compound: if you delay one year, you get an 8% increase; two years = 16% increase; three years = 24% increase; and four years = 32% increase. Thus, delaying collection of your benefit to age 70 can increase your average monthly benefit by 132%, bringing what would have been a $2,500 monthly benefit at age 66 up to $3,300 (assuming no inflation). This is significant, especially if there’s longevity in your family.

One word of caution - Social Security won't take any action regarding activation of your retirement benefit without you prompting them to do so. If you delay to age 70 and assume they'll turn on your benefit automatically (or worse, you forget the delay strategy altogether, which happens more than you'd think), your monthly benefit doesn't continue to increase past age 70. Wait too long, and you can lose months of benefits.

I know what you're thinking - this is all well and good, but I want to collect my retirement benefit as soon as possible. And while I will do my best to convince you this might not be the optimal strategy, let's review what happens to your retirement benefit if you collect before Full Retirement Age.

Reviewing the illustration above, you can collect your Social Security retirement benefit before Full Retirement Age, although a discount is applied to that benefit. On average, the discount is approximately 6.28% per year with the maximum discount rounding out at 25% if you decide to collect at 62. Following our example, an individual with a Primary Insurance Amount of $2,500 would see their benefits fall to $1,875 if they collected their benefit at age 62.

Note that none of the above considers spousal benefits; we address this topic in further detail in a separate blog post.

"But wait!" you say; "You told me when I can collect my Social Security retirement benefit but you didn't tell me when I should collect my Social Security benefit!" You guessed it - there's a blog for that.