Are bond returns still reliable?

We often refer to bonds as the relatively safer side of portfolios. We use bonds in portfolios for many reasons, including reducing volatility (bonds typically do not have the same volatility as stocks), providing income (bonds typically provide more interest income than the dividends provided by equities), and as a reservoir for cash (it is relatively simple to sell short-term bond funds to satisfy both short-term and unexpected cash needs).

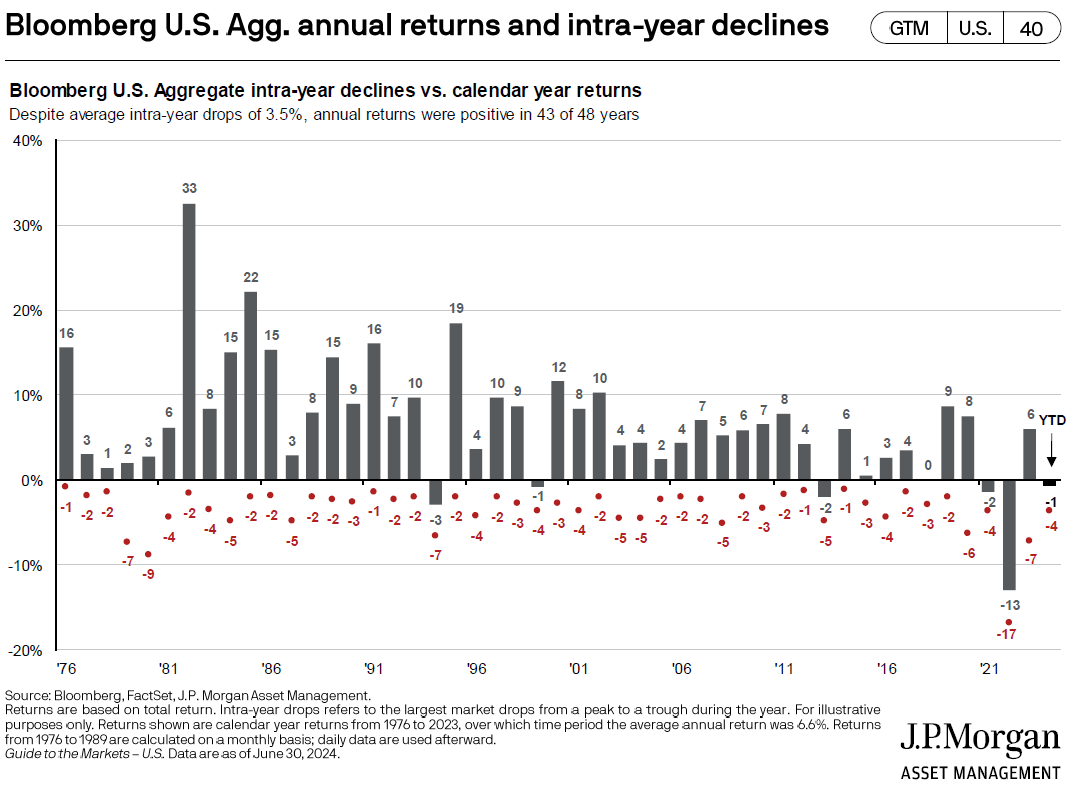

A commonly used bond return index is the Bloomberg U.S. Aggregate Bond Index, a broad-based index that tracks US investment-grade bonds. For approximately the past 50 years, the Bloomberg U.S. Aggregate Bond Index’s average annual return has been approximately 6.6%1. (Please note that this index includes investment-grade bonds of all maturities: short-term, intermediate-term, and long-term.)

Over the past few years, however, we’ve seen unusual bond volatility, with most of it occurring in 2022. That year, the Bloomberg U.S. Aggregate Bond Index fell 13%, an almost breathtaking loss in the bond market. The drop was attributed to numerous interest rate increases by the Federal Reserve as it fought to control inflation.

(A quick primer on bonds: If you pay $1,000 to buy a bond with a 5% coupon and interest rates rise to 6%, the value of the bond will fall. Simply put, why would someone pay you $1,000 for a bond paying 5% when they can get 6% from another bond for the same $1,000? Bond funds must price their inventory at the close of each trading day, so the overall bond market showed a significant decline in value as interest rates increased in 2022.)

Recently, we have seen the opposite occur as markets anticipate the Fed will begin to lower interest rates at its September meeting. Thus, the bond funds we own have increased in value year-to-date as of the drafting of this letter as the individual bonds each fund owns are priced at higher and higher valuations.

The chart below depicts annual returns and intra-year declines for the Bloomberg U.S. Aggregate Bond Index. Looking at the net loss in 2022, you can see the performance anomaly relative to the past 48 years.

To further demonstrate how the bond market has moved in just the past few months, the year-to-date (YTD) performance shown on the chart for 2024 is through June 30th. It shows a loss of approximately 1%. But the Bloomberg U.S. Aggregate Bond Index is actually up 3.2% through August 2, 20242

In response to the question regarding the reliability of bond income as part of a portfolio, the answer, in our opinion, is still a resounding “yes.” Aside from price fluctuations due to interest rate changes, don’t forget that bonds pay ongoing income, which is quite useful for cash flow purposes.

1 “Bloomberg U.S. Agg. annual returns and intra-year declines,” Slide 40, Guide to the Markets, J.P. Morgan. June 30, 2024.

2 Morningstar Office, return calculations available upon request.