Gone are the days when the pleas of a Nigerian prince offering us millions in lottery winnings (via email, no less) were clearly too good to be true. Cybersecurity fraudsters continue to hone their skills on a daily basis. Once again, it's time to take note...this time, with a focus on AI, or artificial intelligence.

There's a lot of information out there about Social Security - let's separate the fact from fiction.

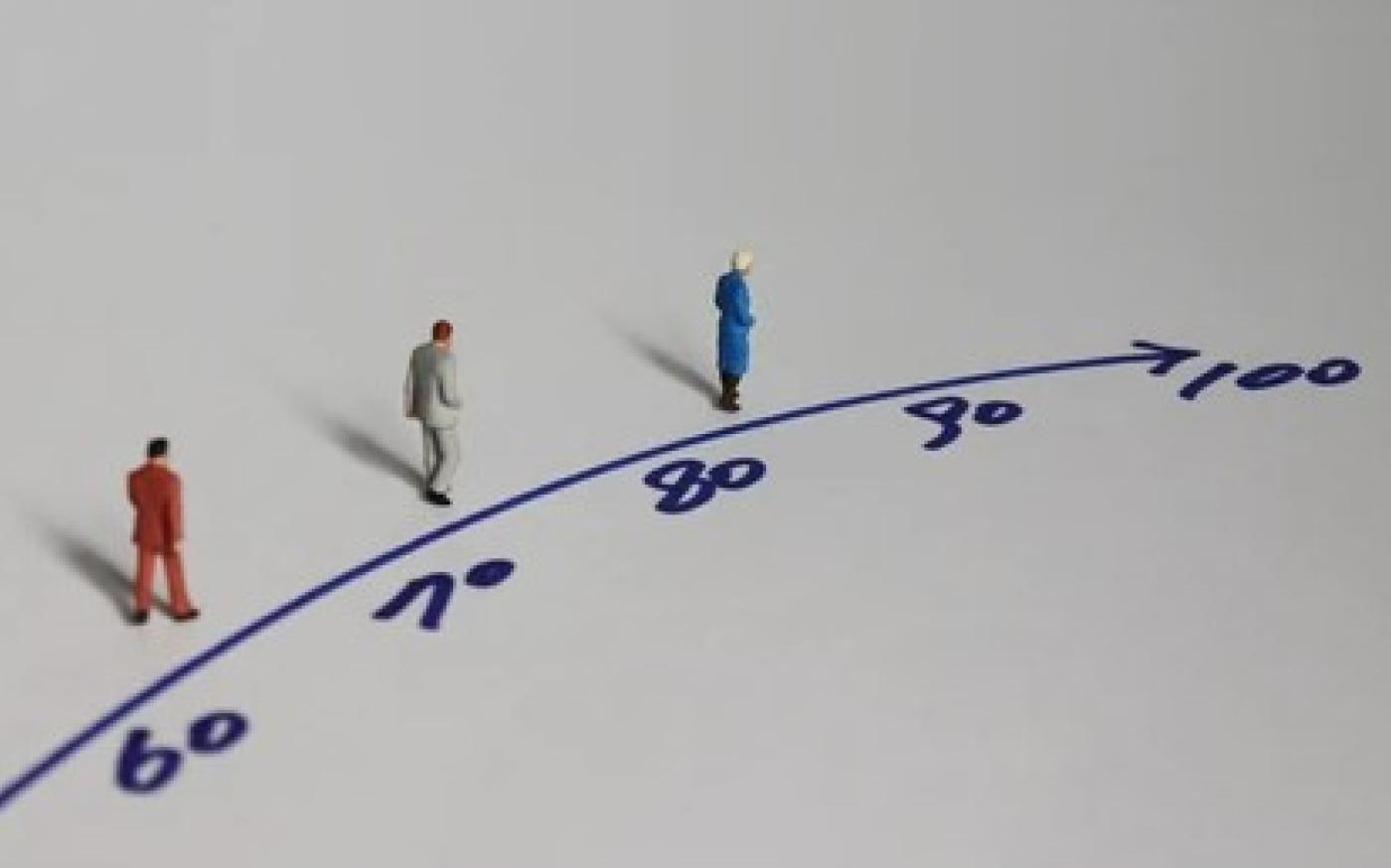

Go back even one generation and you’ll find that retirement was fairly well defined. After working for perhaps 40 or so years, retirees could look forward to an additional 10 or so years of retirement. While those numbers were certainly not absolutes, retirement ages and life expectancy were fairly common. If you fast forward to today, a lot has changed, for several reasons.

There’s an old Yiddish expression that rings true far too often in life: “Man plans, and God laughs.” The obvious meaning is that we all try to plan how our lives should unfold only to discover how much we don’t control.

When you’re in the business of financial planning, certainty is rarely an outcome. If someone were to retire with $10 million in investable assets, for example, while spending $50,000 per year, we could say with (almost) absolute certainty that they will never outlive their money. The truth is, however, that most of us have fewer assets, spend more each year, or some combination of the two. Thus, for the rest of us, the outcome of our financial plans falls into a range of probabilities.

Many investors think they have sufficient knowledge to time the market despite the overwhelming evidence and compelling story to the contrary…Picking stocks is more like gambling than investing.

Stan’s World has gotten more interesting of late but in a good way. Before sharing more, let’s recap - in one word - the singular highlight from the last Stan’s World: Puppy!

Utter the words “credit card,” and reactions can run the gamut. At one end of the spectrum are people who never use a credit card because they do not want to end each month with debt. At the other end of the spectrum, some people have learned to use credit cards in the most effective ways imaginable. Which one are you?

Consider December 2019, when unemployment, interest rates, and inflation were at historically low levels. What would you have done with your portfolio if you knew then what you know now?

When watching movies that star Nicholas Cage or Jack Nicholson, there’s usually a time when the viewer wonders: “Has he lost his mind?” With that cinematic preface, let me share that my ‘lost his mind’ moment apparently occurred a few weeks ago.